Entrepreneurs who want to expand their business must do so through partnerships, i.e. they must partner with real, live human beings and not through entities invented by state law. A partnership is an agreement between two or more specific parties, i.e. one party can't sell their stake to another party without getting permission from the existing partners. Consequently, no longer can companies issue stocks (or other equity instruments) on a public exchange to obtain capital. Such a rule would also apply to private corporations.

This policy will be explored in two posts. The first post will explore the impact of public companies on the economy. The second post will explore the partnership structure as an alternative to stock-based companies.

Part 1: The Impact of Public Companies on the Economy

Stocks: Investments or a "Concentrator" of Wealth? In business schools, stocks, mutual funds, and other equity investments are presented as ways to grow ones wealth and retire early. For entrepreneurs, the possibility of going public is one way that a start-up can make "10X returns". On the other hand, corporations are seen as having too much power. This is not just the Occupy Wall Street crowd, but also the average American. According to a 2013 Gallop Poll survey, 61% of Americans are dissatisfied with the "size and influence of major corporations".

How much economic power do corporations have? A New Scientist study found that a “super-entity” of 147 tightly knit companies controlled 40 percent of the total wealth within the network of 43,000 transnational companies. “In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network,” says Glattfelder [an author of the study]".

The following graphic (taken from the study), illustrates the web of relationships between the 1,318 main companies in the network, where the red means super-connected and yellow signifies very connected. The dot size indicates amount of revenue each company earns.

How do stock markets help the wealthy amass power? The study noted above highlights the role of the stock ownership structure itself as a key tool used by the wealthy to amass power. For example, it notes that the 1,318 companies collectively control - through stocks - the "world’s large blue chip and manufacturing firms – the “real” economy – representing a further 60 per cent of global revenues". The study also found that a "total of 737 [shareholders] control 80% of [the wealth in the network]" (Click here for the actual study). Clearly, stocks are key mechanism for the elite to control the economy.

A good example of how a company used the stock market to dominate their industry is Tyson Foods. Tyson Foods, who controls 24% of the beef market and leads "ready-to-cook chicken market", was able to dominate the food market by going public. As a private company, Tyson foods was able to survive the 1961 downturn in the chicken industry by burning through its operating capital and taking on debt. The company's owner, Don Tyson, feared that his debt laden balance sheet would end badly.

His solution?

Take the company public and buy out the competition:

"Tyson couldn't get bigger just by adding more farms or slaughterhouses. If the company expanded its own operations, it would put more chickens on the market inevitably leading to oversupply. But buying a competitor neatly solved two problems with one move inevitably leading to oversupply. But buying a competitor neatly solved two problems with one move. Tyson could expand without boosting the overall supply of chicken. Tyson simply bought out its competitor's market share without adding one bird to the market. It was part of Don Tyson's new strategy, called “Expand or Expire.""

Public companies can also use their equity as a currency to acquire other companies. For example, Lionsgate (who bought Starz), Aetna (who bought Humana) and CIBC (who bought PrivateBancorp) were all able to acquire other companies through "cash and stock deals" - where they will able to pay for part of their acquisitions through the stocks that they have issued.

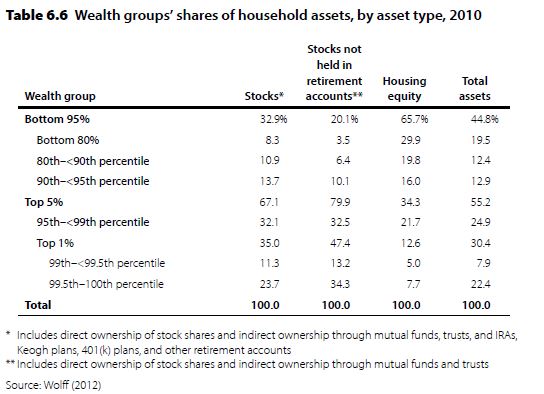

Do stocks and mutual funds help democratize wealth? No, they don't. Stock wealth is concentrated in the hands of the few. The bottom 80% in the US holds a total 3.5% of stock held outside of retirement accounts, while the top 1% owns 47.4% of such stocks. (See the table below, taken from Chapter 6 of Cornell University's State of Working America)

It’s quite startling to realize that all the television shows and press dedicated to stocks really only matter to the top 20% of the population. The remaining 80% do not partake in this most capitalist of endeavours.

How do stock valuations destabilize the economy? The problem lies in the gap between the financial economy and the real economy. In 1932, after the Great Crash, "stocks were worth only about 20 percent of their value in the summer of 1929", which makes stocks responsible for "accelerat[ing] the global economic collapse [i.e. the Great Depression]". This is not limited to the Depression but is commonplace. The 2008 Financial Crisis saw a "temporary decline of roughly $37 trillion" and a "persisting erosion" of $10-12 trillion. In the fall of 2015, "[g]lobal equity markets suffered a bruising third quarter, shedding $11 trillion worth of global shares over three months. In June 2016, after the British voted to leave the European Union, "[b]etween Friday and Monday, worldwide markets hemorrhaged more than $3 trillion in paper wealth...approximately $1.3 trillion of that came from U.S. markets alone".

How can this be? How can trillions of dollars asset exist on one day and then completely vanish on the next?

Stock markets are built on forecasting future valuations: "This extraordinary capacity to finance not on past accumulated wealth but on the present value of future anticipated cash flows is at the core of America's dynamic approach to wealth creation."

It should be kept in mind that behind these vanishing millions are real people whose lives and hopes for the future have been ruined by placing their savings in stocks. For example, when Enron went bankrupt, "[t]ens of thousands of Enron employees and retirees together lost as much as $1.3 billion", including:

- Janice Farmer who "had $700,000 in her 401K — her life savings, all in Enron stock, built up over 16 years".

- Charles Prestwood who lost "13,500 shares were worth about $1.3 million at peak".

- Wayne Stevens and his wife Katherine who both"had stock worth over $700,000".

In other words, market capitalizations are based on a guess - not the actual hard asset values. It is this chasm between paper-wealth and reality that is the source of the trillion fluctuations in wealth. Interestingly, this is viewed as a "dynamic approach to wealth creation" instead of a disaster-waiting-to-happen.

In the next post, we will explore the role of Islamic approach as an alternative to public or private corporations and how it works a means to check the power of those who own capital.